What Are The Most Important Factors To Be Thinking About When Purchasing An Email List Of Pathologists? To ensure that the lists of pathologists that you purchase are valid and legal, as well as suitable for your marketing goals There are many important factors you should consider. These are the main elements to be considered: 1. Data Quality and A

30 Excellent Suggestions For Deciding On Devil666 Slot Sites

Top 10 Security Tips For Devil666 Slot Indonesian Online Betting Platforms It is crucial to protect the security of Devil666 Slot Indonesian betting sites online to safeguard your personal and financial information, and also have an enjoyable and safe gaming experience. Here are ten top strategies to analyze and verify the security of Devil666 Slot

30 Best Pieces Of Advice For Choosing 7raja Togel Sites

Ten Suggestions For 7 Raja Togel Indonesian Betting Platforms That Offer Game Variety When you choose 7 Raja Togel Indonesian-based online betting platforms, the variety of games is among the primary elements that can improve your betting experience. A variety of games gives you an increased variety of betting options, and will provide you with a m

30 Best Tips For Picking ASIAN2BET Login Websites

Top 10 Tips On Regulation And Licensing For IDNPLAY Indonesian Online Betting Platforms Understanding the ASIAN2BET Login Indonesian regulatory and licensing framework when evaluating ASIAN2BET Login Indonesian online betting platforms is crucial to ensure that you have an enjoyable and secure betting experience. Here are 10 important tips to ensur

30 Top Pieces Of Advice For Choosing Tajir4D RTP Websites

Top 10 Suggestions To Help You Pick The Best Game For Your Betting Online Platform In Indonesia The choice of games is an essential aspect when choosing tajir4d togel Indonesian betting platforms. It will enhance your experience of betting. The variety of games gives you greater options for betting and provide a more enjoyable and diverse experienc

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Jennifer Love Hewitt Then & Now!

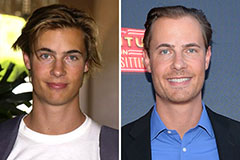

Jennifer Love Hewitt Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!